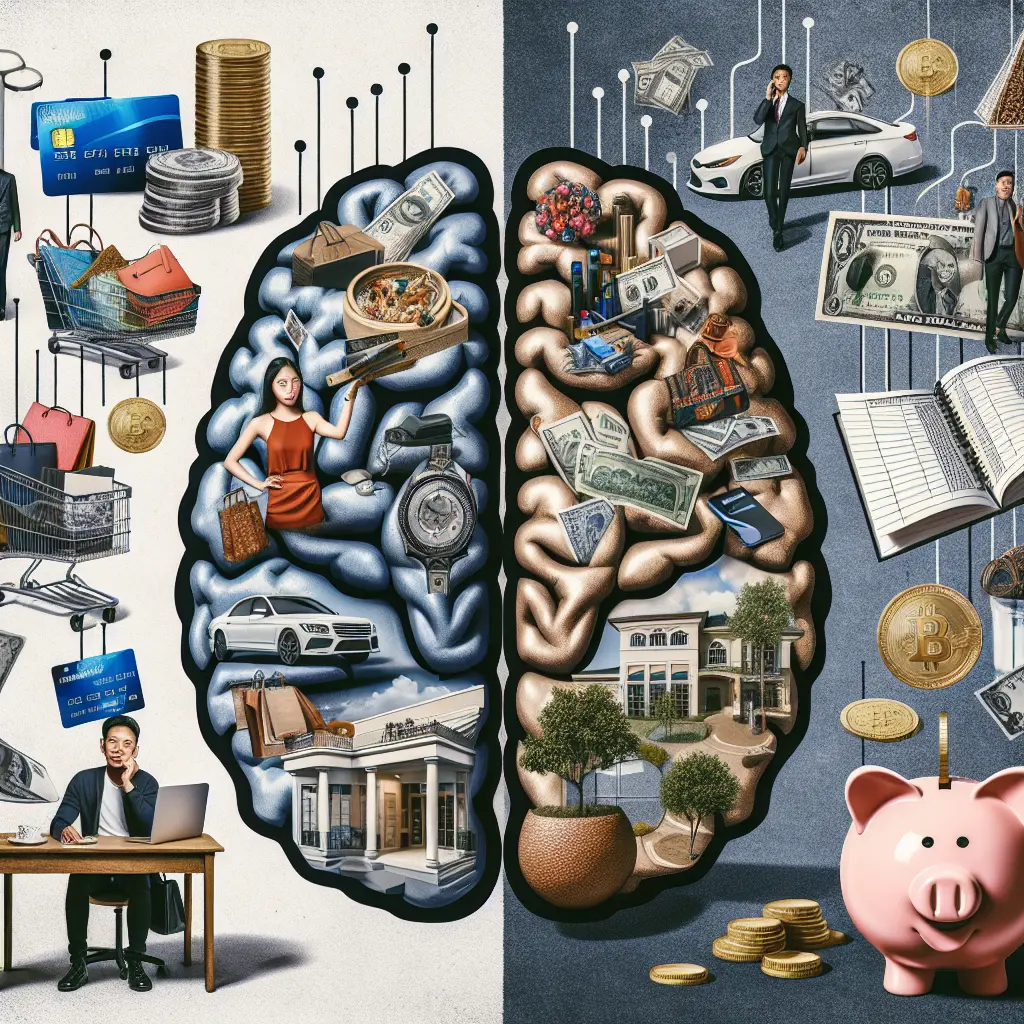

In today's rapidly evolving financial landscape, understanding the psychology of spending and saving is more crucial than ever. Financial psychology delves deep into the cognitive and emotional mechanisms that drive our financial behaviors. By examining recent developments, we can gain insight into how these psychological factors influence our spending and saving habits.

The Influence of Impulse Buying and Emotional Spending

Spending behavior is a complex interplay of cognitive and emotional triggers. With the rise of consumerism, impulse buying psychology has become increasingly prevalent. Emotional spending triggers, such as stress or happiness, can significantly impact our purchasing decisions. For instance, as luxury brands like Lucid Motors unveil new models like the Gravity SUV, consumer excitement can lead to increased impulse purchases (Yahoo Finance).

To mitigate the effects of emotional spending, individuals can implement budgeting psychology techniques. Recognizing emotional cues allows one to foster healthier financial habits and reduce impulsive expenditures. Consider maintaining a spending diary to track emotional triggers associated with spending, paving the way for better financial management.

Cultivating a Saving Money Mindset

Saving habits psychology explores why some individuals excel at accumulating wealth while others struggle. The saving money mindset is not just about setting aside funds but also about cultivating a proactive approach to financial security. Recent economic news, such as Thailand's baht poised to appreciate due to stable policy rates, highlights how external economic factors can influence personal saving strategies (Bangkok Post).

Developing tailored money-saving strategies is essential for navigating complex financial environments. Exploring high-yield savings accounts or investing in stable sectors can be beneficial when economic conditions are favorable. These strategies align with the broader goal of enhancing one's financial well-being through informed decision-making.

Consumer Spending Habits and Financial Decision Making

The intricacies of consumer spending habits are further complicated by market dynamics and psychological factors in spending. For example, mortgage rates are a critical consideration for potential homeowners. A recent review of Regions' mortgage options shows relatively high rates but low fees, presenting a nuanced decision-making process for consumers (U.S. News & World Report).

Understanding financial decision-making through a psychological lens involves weighing immediate desires against long-term benefits. Utilizing decision-making frameworks that account for both rational analysis and emotional influences can lead to more balanced financial choices.

Economic Behavior Psychology in the Context of Current Events

Economic behavior psychology is influenced by both internal dispositions and external events. Geopolitical tensions or economic policies can affect currency valuations and market stability. For instance, recent developments in Thailand’s energy negotiations suggest potential long-term low energy prices, offering insights into strategic long-term financial planning (The Nation Thailand).

Incorporating these economic insights into personal finance strategies helps individuals adapt their behaviors in response to macroeconomic trends, ensuring resilience in times of volatility.

Enhancing Financial Habits Through Education and Engagement

To effectively harness the power of financial psychology, ongoing education and engagement are crucial. Platforms like Circa Million's NFL contest not only engage users with their interests but also incorporate elements of risk assessment and reward evaluation, reflecting core principles of money management psychology (Las Vegas Review-Journal).

Interactive tools and resources demystify complex financial concepts, empowering individuals to make informed choices. Whether through workshops, online courses, or financial literacy apps, continuous learning can foster a deeper understanding of budgeting psychology and money-saving strategies.

Overcoming Barriers to Effective Financial Management

Despite the availability of resources and strategies, barriers to effective financial management persist. Social pressures, limited access to information, or ingrained habits can impede progress. Addressing these challenges requires a comprehensive approach that incorporates both individual insights and societal support structures.

Initiatives like Thailand's digital wallet handout policy aim to provide direct financial assistance while encouraging responsible spending practices (Bangkok Post). Such policies highlight the importance of integrating psychological insights with practical solutions to promote financial stability.

The Role of Psychological Factors in Shaping Financial Futures

As we unravel these psychological complexities, it’s essential to consider both conscious and subconscious elements at play. The integration of psychological factors into money management strategies can unlock new potential for personal financial growth. Whether through structured savings plans or adaptive spending approaches, understanding the interplay between thoughts, emotions, and behaviors is key to shaping our financial realities.

Conclusion: Embracing Financial Psychology for a Prosperous Future

Understanding the psychology of spending and saving is essential for navigating today's financial landscape. By acknowledging the emotional and cognitive drivers behind our financial behaviors, we can enhance our financial decision-making and improve our economic well-being.

Let's recap some key points:

Impulse Buying and Emotional Spending: Emotional triggers significantly impact purchasing decisions. Recognizing these cues and implementing budgeting techniques can mitigate impulsive expenditures.

Saving Money Mindset: Cultivating a proactive saving mindset involves not just setting aside funds but also adapting to external economic factors to improve financial security.

Consumer Spending Habits: Decision-making frameworks that balance rational analysis with emotional influences lead to more informed choices, especially when navigating mortgage options or other complex financial products.

Economic Behavior Psychology: Adapting to macroeconomic trends, such as geopolitical tensions or energy negotiations, helps ensure resilience in volatile times.

Education and Engagement: Continuous learning through interactive tools and resources empowers individuals to understand complex financial concepts, fostering better money management strategies.

Overcoming Barriers: Addressing social pressures and ingrained habits requires combining individual insights with societal support structures, as seen in initiatives like Thailand's digital wallet policy.

Embrace the art of financial psychology by integrating these insights into your personal finance strategies. Reflect on how your thoughts and emotions influence your financial behaviors and take steps to adapt and grow. Engage with this journey by sharing your experiences or thoughts on how psychological insights have shaped your financial habits.

In mastering these psychological principles, we unlock the potential for personal financial growth and secure our economic well-being for the future. Your financial journey is a continuous path of learning and adaptation—embrace it with confidence and curiosity.

Author: Adrian Foster